Sources: Per cumulative publicly disclosed Investment Banking revenues from 2020–2023. Peers include MS, JPM, BAC, C, BARC, DB, UBS, CS (through 2022); Reflects clients within the One Goldman Sachs program with revenue impact across three or more of our business units – includes GBM Public, GBM Private, AM Public, AM Private, PWM. Excludes Ayco, TxB, XIG. As of December 2023; Goldman Sachs Quarterly Report on Form 10-Q for the period ended March 31, 2024 - see "Results of Operations - Asset & Wealth Management - Assets Under Supervision”. Firmwide AUM includes assets managed by Goldman Sachs Asset Management and its investment advisory affiliates.

We harness the best people, ideas, and expertise from across the firm to solve problems with the ingenuity and excellence expected of Goldman Sachs.

We mobilize the firm’s expansive network to serve our clients with a range of financial solutions differentiated by their breadth, depth, and geographic reach.

For 155 years, we have been a trusted partner to the world’s leading businesses, entrepreneurs, and institutions.

Goldman Sachs acts as book running manager of the initial public offering for software company Microsoft corporation. Generating US$61 million for Microsoft. It is dubbed by many analysts "the IPO of the year" in 1986.

On February 4, 2000, Britain's Vodafone AirTouch PLC acquires Mannesmann AG any historic deal that will reshape the mobile telecom marketplace.

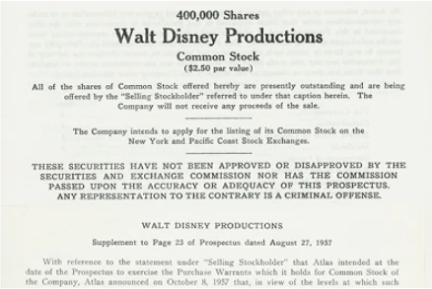

Goldman Sachs leads Disney's initial public offer at a share price of US$13.88 on the New York Stock Exchange in 1957.

Our weekly newsletter with insights and intelligence from across the firm

By submitting this information, you agree to receive marketing emails from Goldman Sachs and accept our privacy policy. You can opt-out at any time.